Experts warn of ‘cataclysmic’ scenario if world’s biggest economy fails to meet its debt obligations.

As a game of chicken plays out in Washington, DC, over whether to raise the limit on US government borrowing to avoid a default on its debt, the one thing that experts agree on is that a default would be catastrophic.

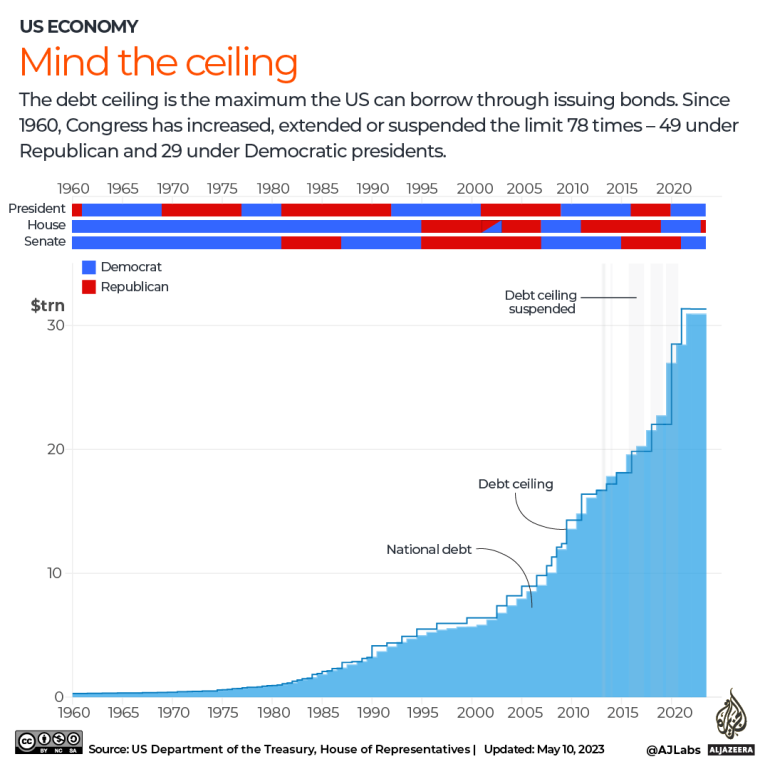

The United States hit its borrowing limit on January 19. Since then, the US Treasury has implemented a number of measures to avoid a default, but it is only a matter of days, or weeks at most, before those are exhausted and the US government is unable to pay what it owes.

KEEP READING

list of 4 items

Aid groups urge debt cancellation to ease Ghana’s economic woes

Is debt cancellation the way forward for Sri Lanka?

G20 creditors on board for Ghana debt relief talks: Paris Club

Want to fix the climate? End debt traps

end of list

Here’s an explainer on what happens if this unprecedented event takes place.

What are the chances that the US will indeed default?

No one really knows because it is “a political issue”, Lawrence J White, an economics professor at the Stern School of Business at New York University, told Al Jazeera.

“I keep hoping there will be a resolution, but this is a game of chicken, and usually somebody swerves and a head-on collision is avoided… but sometimes people go over the cliff, and that is the big worry,” he said.

To avoid a default, Congress would have to lift the debt ceiling, but Republicans are demanding spending cuts to do so. President Joe Biden, a Democrat, wants a simple vote in Congress that would only deal with raising the government’s debt limit.

Worry about the deadlock has amplified in the past few days as the so-called X-date – when the Treasury would run out of money to pay its bills – has moved up from mid-August to as early as June 1 on account of low tax collections in April, Bernard Yaros, assistant director at Moody’s Analytics, told Al Jazeera.

If the Treasury can limp along until mid-June, Yaros said, it will have a “surge” in tax receipts from businesses and individuals and close to $150bn in new extraordinary measures that will help it keep money flowing through late July or even early August.

But it is not clear it will get that breathing room.

What is the worst-case scenario?

The US goes into a weeks-long default with Republicans and Democrats digging in their heels.