By Sainabou Sambou

The High Court in Banjul heard testimony on Tuesday from civil engineer Seena Shams in the ongoing money-laundering trial of Paulo Djabi, Nadine Ismael de Gouveira Pereira, and Mamadou Neto Djabi.

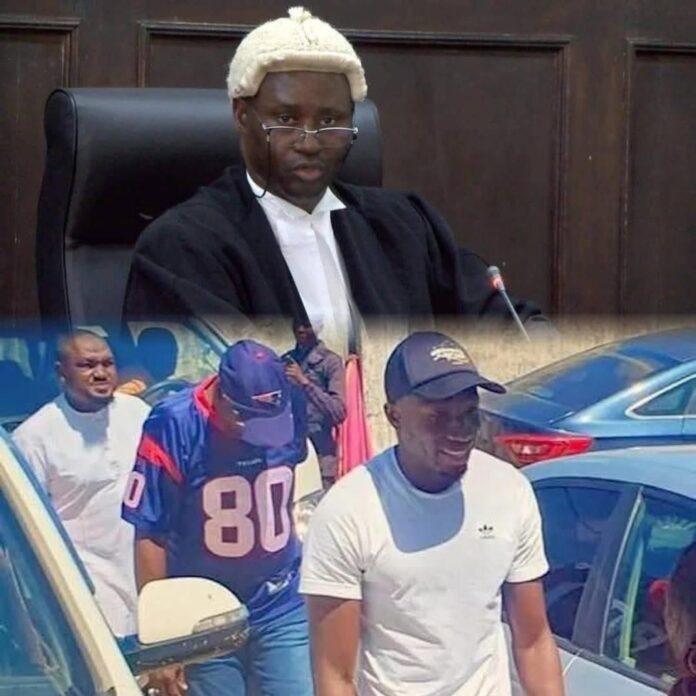

Presided over by Justice Ebrima Jaiteh, the proceedings featured State Counsel S. L. Jobarteh leading the prosecution, while Defence Counsel S. M. Tambadou represented all three accused.

Appearing as Prosecution Witness Eight (PW8), Shams identified himself as a resident of Fajara and Operations Director at Construct Limited, his family’s construction and real estate business. He explained that the company, incorporated in 1991 in Westfield, The Gambia, focuses on construction, property sales, and rentals. It is owned by his parents, Faramarz Shams (90% shares) and Fadieh Shams (10% shares).

Shams oversees daily operations, including construction, sales, procurement, and client relations. He noted that the family also operates related entities, including Waterfront Fajara Limited (incorporated around 2011), Gem Waterfront Limited, Orchid Waterfront Limited (both incorporated around 2019), Ocean View Limited, and Relax Waterfront Limited.

In court, the witness identified the first accused as Paulo Djabi and the second as Nadine Ismael de Gouveira Pereira. He stated he had never met the third accused, Mamadou Neto Djabi, prior to the proceedings.

Shams testified that in early 2022, he began dealing with real estate agent Mariama Kaira, owner of Linkage Africa, who had collaborated with Construct Limited for over a decade by referring clients in exchange for commissions.

He said Kaira introduced several buyers to the company, including Paulo Djabi, in the same way she referred other clients. Shams described Linkage Africa as an agency that connects prospective buyers with developers.

According to Shams, Kaira personally purchased six properties from the company using her earned commissions. These included several units at Fajara Waterfront: Units P7, A6G3, A3G3, and P4 (the latter transaction remains incomplete). Unit P7 was bought in the name of Kaira’s husband or son, while Units A6G3 and A3G3 were registered in her own name.

Shams further stated that Kaira later informed him she had entered a partnership with Paulo Djabi because she could not complete payments independently. He emphasized that no formal partnership agreement was ever provided to the company, and the alleged arrangement was based solely on Kaira’s verbal disclosure.

The witness noted that payments for the properties were made via wire transfers, bank deposits, and, in some cases, money exchange services. He estimated Unit P7 at approximately US$450,000 and Units A6G3 and A3G3 at about US$300,000 each. Payments for Unit P7 were partly made through commissions and wire transfers from the United States, while deposits for the other units involved various parties, with Kaira claiming that Djabi lent her money and arranged some payments.

Shams confirmed that Construct Limited issued official receipts for all payments and prepared sale agreements for Units A6G3 and A3G3. However, those transactions remain incomplete and overdue despite follow-up emails and calls.

Under examination by State Counsel Jobarteh, the witness identified and tendered 30 documents into evidence, including invoices, balance statements, payment plans, and unsigned sale agreements related to the property acquisitions.

The defence did not object to the invoices or balance statements but challenged the admissibility of the unsigned sale agreements, arguing they were not properly executed.

Justice Jaiteh overruled the objection in open court, ruling that the documents could be admitted. He noted that the defence retained the right to contest their authenticity, credibility, and evidential weight during cross-examination and final submissions. The items were marked as exhibits P-30, P-31, and P-32. The judge indicated the ruling would be edited before issuance of the final written version.

The trial was adjourned to January 20, 2026.

The three accused face multiple money-laundering charges, which the prosecution alleges stem from financial transactions under investigation, including property purchases in areas such as Fajara Waterfront. The case has drawn attention amid broader allegations involving foreign currency dealings and real estate investments in The Gambia.