The United Democratic Party (UDP) has renewed its call for greater transparency in the sale of Mega Bank, questioning whether the transaction truly served the national interest amid ongoing concerns over public funds and accountability.

In a press statement from its Media and Communications Team, the opposition party highlighted testimonies before the National Assembly’s Finance and Public Accounts Committee (FPAC), where Central Bank of The Gambia (CBG) Governor Buah Saidy confirmed Mega Bank was sold to KM Holdings for US$15.25 million. This followed a government injection of D650 million in taxpayer funds to resolve the bank’s toxic assets, primarily non-performing loans.

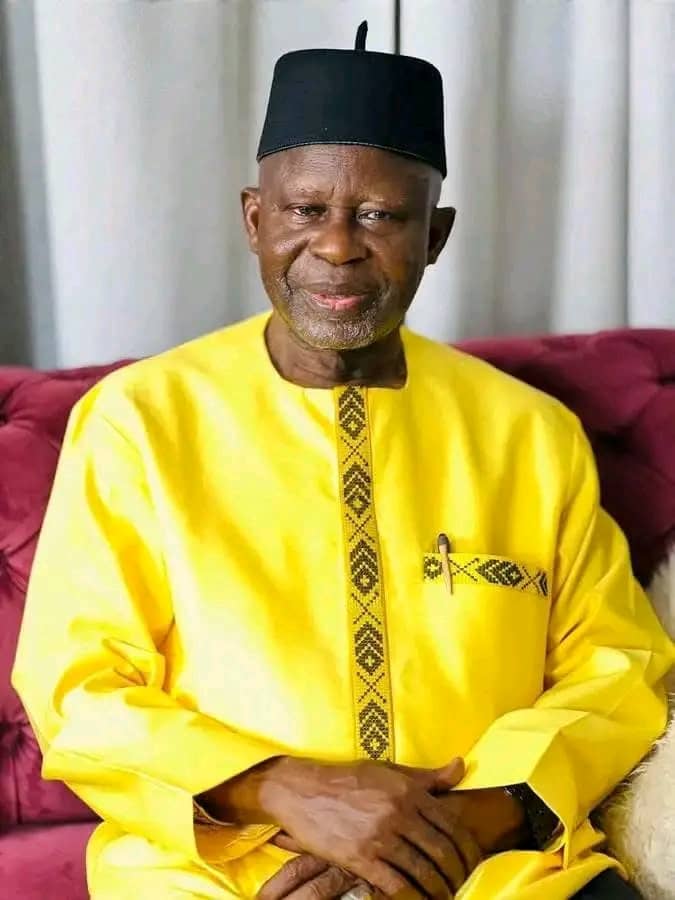

The UDP emphasized that these issues, raised by party leader H.E. Ousainou Darboe and economists Lare Sisay and Lamin Manneh, are rooted in official reports and hearings rather than partisan motives. Core questions include: Why commit such significant public money to stabilize the bank before sale? Did the US$15.25 million price reflect its post-intervention value? And who ultimately profited?

The 2023 Auditor General’s Report identified an undisclosed balance of D24,442,558.89 from the sale, urging full disclosure and evidence. The CBG linked this to consultancy fees paid to DT Associates via Guaranty Trust Bank, but auditors described prior CBG documentation as unclear and incomplete, impeding verification.

Partial recoveries were noted—D60 million reportedly returned to the government and D20 million held in an account—yet the UDP argued the deal’s structure merits scrutiny. It questioned the existence of an independent valuation, a competitive bidding process, and proper procurement of consultancy services.

“When public funds, especially hundreds of millions of dalasis, are involved, transparency is not optional. It is a legal and moral obligation,” the statement declared.

The party demanded immediate action from the Barrow administration and CBG, including release of the valuation methodology, detailed consultancy contracts and payments, transparent records of toxic asset recoveries, and assurances on taxpayer fund protection.

Without these, the UDP warned, public confidence—already undermined by audit gaps—will erode further, potentially indicating administrative lapses or intentional opacity.

The statement framed the controversy as a matter of national interest, not rivalry: publicly rescuing a bank that is demonstrably beneficial to Gambians.

“The Gambian people deserve clarity. They deserve accountability. Above all, they deserve assurance that their resources are being managed in their best interest,” the opposition party said.

The Mega Bank privatization, finalized around 2023–2024 with details emerging in audits and hearings, continues to fuel debate in Gambian politics and media.