By: Kemo Fatty

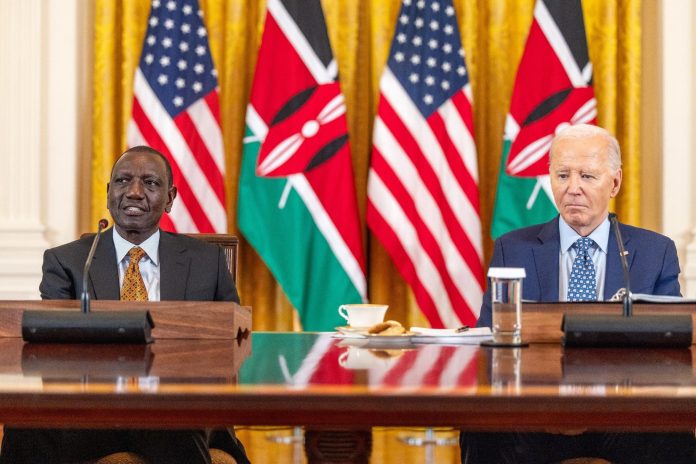

In celebrating their 60 years of bilateral partnership on Thursday May 23 at the White House, the United States and the Republic of Kenya have reaffirmed their commitment to leading a global transition for the economies of the future through multifaceted areas of growth including education, technology, security, and development. During a historic state visit by the Kenyan President to the United States, President Biden outlined a new vision for Kenya called the “Nairobi-Washington Vision 2024.” This vision marks perhaps the greatest foreign policy plan and bilateral relationship between the two nations.

Recognizing the strategic security ambitions of the North Atlantic Treaty Organization (NATO) and the need to maintain global security dominance, President Biden announced Kenya as the major non-NATO ally in Africa. This designation will expand NATO’s influence in Eastern Africa, providing a security umbrella to support critical issues in the Horn of Africa and the Great Lakes region, particularly in combating Al-Shabab insurgents and fostering collaborative counter-terrorism efforts to build peace and security.

On international financial institutions and their support for developing countries, particularly Kenya and East African nations, Biden committed to increasing financial aid for the region. He pledged $21 billion (about $65 per person in the US) to promote bottom-up business in Kenya, while also facilitating opportunities for more Kenyan students to study in American universities in STEM fields. Kenya will be the first African country to receive chips and science support from the U.S. aimed at enhancing its educational programs. In appreciation of Biden’s commitments, the Kenyan leader challenged the U.S. to further increase and remain supportive to Kenya and Africa at large.

The following are the key elements of the Nairobi-Washington New Vision 2024 (Courtesy of the White House)

High-ambition countries receive high-ambition financial support. Countries with high ambition with respect to investments in their own development, addressing cross-border challenges like the clean energy transition and strengthening health systems to be better prepared to respond to the next pandemic, and undertaking economic reforms to make these investments sustainable are met by high ambition from international financial institutions, including the IMF and World Bank, and from official bilateral creditors.

International financial institutions step up with coordinated packages of support so high ambition countries don’t have to choose between servicing their debts and making necessary investments in their futures. International financial institutions ensure their programs account for the fiscal space high-ambition countries require for needed investment. Together, the IMF and MDBs deliver enhanced, coordinated support packages that capitalize on new and expanded resources, including by maximizing the right mix of financing; scaling up concessional financing with stepped-up support from donors; and fully utilizing sustainability-focused funds, the broader climate finance architecture, and other pools of concessional finance.

Creditor countries provide reprieves for high ambition developing countries. Official bilateral creditors pledge to sustain positive net inflows by offering debt suspensions, reprofiling’s or restructurings, or new budget-support flows as necessitated by countries’ debt sustainability and investment needs. Free riding from individual creditors who get paid back from multilateral support should end, and the IMF should enforce this norm and equitable treatment more broadly with its policies, including lending into official arrears. Creditor countries should also maximize their use of grants and development finance institution flows to support countries’ development and climate needs.

New tools facilitate private sector finance on better terms. MDBs and national development finance institutions (DFIs) provide incentives to private sector creditors to replace or refinance high-cost private sector sovereign loans and debt with lower-cost, longer-term, and more transparent and resilient debt. This includes expanding access to debt guarantees and by creating safe harbors for countries that proactively and voluntarily manage debt burdens, such as through new concessional finance, debt swaps, and debt conversions.

Transparent, sustainable, and resilient financing replaces opaque and unsustainable lending. For example, all creditors should adopt clauses to automatically provide sovereign debt service suspension when debtor countries experience climate-related disasters. Non-disclosure agreements that keep citizens and their creditors in the dark about the terms of sovereign lending should no longer be used.

Enhanced support crowds in private investment. Private sector-focused MDBs and bilateral official creditors, including through DFIs, enhance support for private investments in sustainable finance by scaling up vehicles that help mobilize private capital and deepen local capital markets. Through these and other tools, the private sector is incentivized to expand their portfolio for climate-related development finance in emerging economies.

However, will this new foreign policy strategy shift the balance against China’s growing dominance in Africa?

Studies have confirmed that developing countries’ debt payments to the rest of the world exceed the new financing they receive, with more particularly Africa are facing significant debt distress. The United States’ new vision for Kenya aims to shift the balance from debt dependence to financial independence for developing countries. This contrasts sharply with China’s approach, which relies heavily on loans. Between 2000-2022, 39 Chinese lenders provided $170.08 billion to 49 African governments, compared to the African Development Bank’s $36.85 billion in sovereign loans to Africa. As of 2022, Africa’s public debt had increased by $1.8 trillion, a 183% rise since 2010.

China’s Belt and Road Initiative (BRI), launched in 2013, targets emerging economies through a global infrastructure development push, while extending China’s geopolitical and economic influence, particularly in Africa. This strategy has made China as Africa’s largest bilateral creditor for development assistance on the continent.

Despite China’s current position in meeting the need of many powerful local constituencies across Africa, the U.S. approach, focusing on strengthening African institutions and promoting financial independence, as well as dissuading African countries taking huge loans will undoubtedly present a significant challenge to China’s influence. By promoting fiscal policy through strategic mechanisms, the U.S. aims to reduce Africa’s debt crisis, thereby impacting China’s dominance in the region. If effectively implemented, the Nairobi-Washington Vision 2024 could foster a major shift in Africa’s financial landscape, while also reducing reliance on foreign loans and enhancing sustainable development.

References

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/23/the-nairobi-washington-vision/

- https://www.bu.edu/gdp/2023/09/18/a-new-state-of-lending-chinese-loans-to-africa/

- https://www.reuters.com/world/africa/chinese-loans-africa-plummet-near-two-decade-low-study-2023-09-19/

- https://www.americanprogress.org/article/5-things-u-s-policymakers-must-understand-china-africa-relations/