By: Foday Manneh

Digital Fintech firms are making a rush for the West coast with a new wave of investments moving to expand services in a dynamic market.

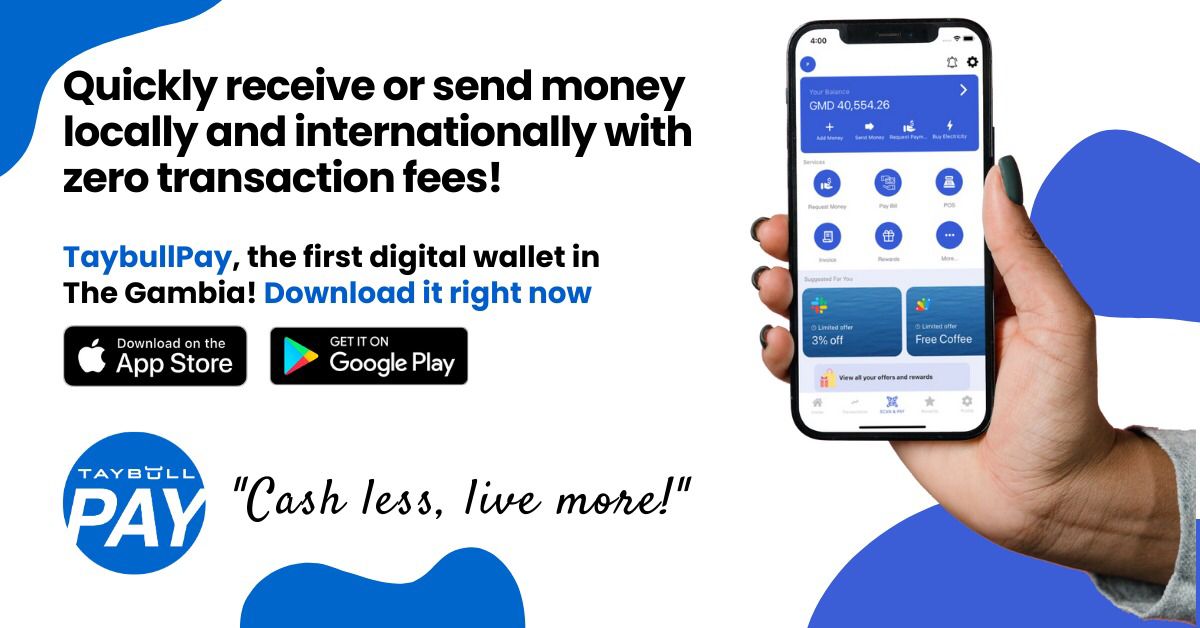

Taybull Soft is the latest of those investors as the fintech company involved in Digital banking and financial services settles in the Gambia.

Taybull Soft operates alongside its UK-based sister company, TaybullPay Limited.

The TaybullPay was launched in November 2021 to promote financial inclusion by encouraging the adoption of cashless transactions.

“Our primary goal is to facilitate easy access to essential financial services for all members of the society — eliminating the need for long bank queues and reducing barriers that prevent certain segments of society from accessing basic financial services,” the Chief Executive Office of TayBull, Kumbale Goode told TAT.

She added, “we aim to promote borderless commerce for all businesses, regardless of size. Our comprehensive services include international and local remittances, bill and utility payment options, bulk fund disbursement, wallet deposit and withdrawal, merchant payment, and shopping, among others.”

The TaybullPay services are available in both the Gambia and the United Kingdom. Additionally, the firm has introduced new remittance processing points in various African countries, such as Senegal and Ghana.

TaybullPay offers some of the most dependable and cost-effective services in the market. Users can buy cash power, make deposits, and pay for services without additional charges.

“We only impose fees for cross-border services and a small fee for withdrawals,” the CEO said.

With its parent company focusing on fintech, TaybullPay is poised to become an outstanding player among financial institutions across the globe, ensuring improved service quality with global partners as crucial players in the financial industry.

“Three key metrics determine the success of our business: reach, accessibility, and adoption rates,” CEO Kumbale said.