An in-depth investigation by TAT has unveiled troubling findings regarding the Gambia Government’s concession agreement with Turkish company Albayrak to manage the Banjul Seaport and develop a Deep Seaport. Key revelations have emerged from the Technical Proposal Evaluation Report, submitted by Maritime and Transportation Business Solutions (MTBS) to the Gambia Ports Authority (GPA) and the Concession Committee.

The TAT investigation has also highlighted the dissolution of the partnership between Albayrak and Negmar, the two companies that initially formed a consortium to bid for the Concession. This breakdown raises significant concerns about the agreement’s viability and legality and questions regarding Albayrak’s technical, financial, and managerial capabilities following the consortium’s collapse.

This development follows the Gambia Government’s approval of the now-defunct Albayrak-Negmar Consortium’s bid to expand the Banjul Seaport and develop the Sanyang Deep Seaport. The agreement, signed on August 20, 2023, was to grant Albayrak management and operational control beginning January 27, 2025.

The evaluation report from MTBS reveals that among the seven companies that bid for the Concession—Albayrak-Negmar Consortium, Bollore, DP World, Marsa Maroc and Tanger Med Consortium, Meridiam, RSGT, and Vilport—only Bollore met the bid evaluation requirements. This finding casts further doubt on the integrity of the bidding process and the subsequent awarding of the contract.

According to the Technical Proposal Evaluation Report by Maritime and Transportation Business Solutions (MTBS), the consortium did not meet several critical criteria, including compliance checks, the organizational and human resources plan, the investment plan, and concession agreement compliance. Despite these deficiencies, the Concession Committee awarded the contract to the Albayrak and Negmar Consortium, bypassing Bollore, which had qualified in all assessment areas.

Additionally, the investigation uncovered that the Albayrak and Negmar Consortium had not provided the evaluators with its third-year financial statement and did not demonstrate sufficient management experience to handle a significant seaport project.

These findings raise questions about the Concession Committee’s decision-making process and the rationale behind awarding the contract to a consortium that did not fully meet the evaluation criteria.

The report on the evaluation of the Albayrak and Negmar Consortium’s proposal has identified several significant gaps in both the Business Plan:

Organizational and Human Resources Plan and the Business Investment Plan. One of the primary concerns is the lack of evidence regarding the consortium’s management experience, specifically the experience of operating a container terminal with a capacity larger than 200,000 TEU for at least five years, during which investments were made in equipment and superstructure. Additionally, there are uncertainties about the quay’s capability to support Ship-to-Shore (STS) cranes and the operation of geared vessels.

Moreover, the report indicates that the Request for Proposal (RFP) lacked several key elements. These include detailed information on investment costs, the phasing of investments, and the division between replacement capital expenditures (CAPEX) needed to maintain current capacity and expansion CAPEX required to increase capacity. Specific areas lacking detail include terminal infrastructure (such as quay walls and berth pockets dredging), terminal superstructure (including paving, buildings, and utilities), terminal equipment (like quay cranes and transport equipment), terminal IT systems (such as the terminal operating system), capacity calculations and drawings, and a strategy for asset transfer at the end of the concession period.

These omissions and uncertainties highlight areas for improvement in the proposal and underscore the need for a comprehensive and detailed approach when evaluating and awarding contracts for major infrastructure projects like seaport management.

Our Investigations highlighted several critical deficiencies in the proposal submitted by the Albayrak and Negmar Consortium for the Concession Agreement with the Government of the Gambia. One issue was the consortium’s failure to specify its construction standards adequately. The report observed that the proposed terminal’s overall capacity would be insufficient to handle the projected container volume. It also noted the lack of a plan to relocate the existing maintenance and repair shop.

The MTBS Technical Proposal Evaluation Report further pointed out that the consortium did not clearly articulate the type of operations planned for the terminal. It urged the consortium to provide historical details of their previous port management experiences, submit a third-year financial report, and clarify whether the construction of berths 3a and 3b could support Ship-to-Shore (STS) cranes.

Subsequent findings by TAT revealed that the Albayrak and Negmar Consortium has since dissolved due to unresolved disagreements over financial, technical, and human resources issues. According to sources within the two companies, Negmar Group’s management withdrew from the consortium after realizing the lack of necessary capital and human resources to undertake such a significant investment and the challenge of raising the $1 billion needed to develop the Sanyang Deep Seaport.

These developments underscore the complexities and challenges of large-scale infrastructure projects, highlighting the importance of detailed planning and robust financial and operational strategies.

The Alkamba Times Contacted a Gambian expert residing abroad who had a deep knowledge of the concession agreement. The expert expressed strong concerns about the implications of mortgaging the Gambia Ports Authority (GPA), which he noted contributes approximately 40 percent to the Gambian economy.

He criticized the proposed revenue-sharing arrangement, which would allocate 80 percent of the revenue generated at the port to Albayrak while providing only 20 percent to the Gambian government. He called this a detrimental decision for the country.

The expert highlighted that the Gambian government and the GPA were aware of the consortium’s limitations, including a lack of capital, human resources, and a robust business plan. He pointed out that Albayrak has not successfully managed a fully operational container terminal independently and has a questionable track record in countries such as Somalia and Guinea-Bissau, which he believes should have disqualified them from consideration.

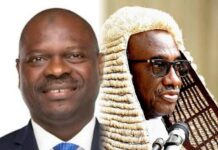

Additionally, he raised allegations against several high-ranking officials, including Mod Ceesay, Secretary General and Head of Civil Service, and Ousman Jobarteh, Managing Director of GPA, suggesting they may have received financial incentives to endorse the concession agreement. He urged the Gambia Police Force and the National Assembly Select Committee on Public Enterprises and Public Accounts to investigate the matter.

These statements reflect the expert’s concerns regarding governance, transparency, and the potential economic impact of the concession agreement.

The expert criticized the government’s claims regarding the feasibility of constructing a deep seaport in Sanyang within two years, suggesting that such assertions were merely a public relations tactic to mislead the Gambian public. He asserted that the cost of building a deep seaport would be at least $1 billion, indicating that only Bolloré met the necessary qualifications among the bidders.

He expressed disappointment over the significant taxpayer funds spent on contracting Maritime Transport Business Solutions (MTBS) to evaluate the bidders expertly, only to see the government disregard their recommendations. The expert emphasized the importance of the Gambia Ports Authority as a national asset, which currently contributes around 40 percent to the economy, and argued that its significance should not be underestimated.

TAT has made several attempts to obtain comments from GPA and Concession Committee authorities through the Public Relations Officer, Gibbou M. Saidy. While Saidy confirmed that all inquiries from TAT regarding the Concession Agreement and the Deep Sea Port had been forwarded to the Concession Committee, there had been no response at the time of this publication.

Our Investigations also reveal that Albayrak’s concession agreements in Guinea Conakry and Somalia have faced significant challenges, including allegations of bribery and corruption. In Somalia, the Company has been accused of misconduct, such as wage theft from employees. It attempts to cover up serious incidents by bribing government officials and inflating port management and operating expenses.

According to reports, before Albayrak’s management of the Port, monthly revenue was around $6 million. After the Company took over, this figure reportedly increased to between $10 million and $12 million monthly. However, in 2014, Albayrak Group reported only $2.7 million in monthly revenue, leading to a decrease in the government’s revenue share from 55% to 16%, while the Company’s share rose from 45% to 84%, as highlighted by Nordic Monitor.

Similarly, in Guinea, the concession agreement awarded to Albayrak by former President Alpha Condé has been characterized as a preferential arrangement. It grants the Company a 25-year lease for the Port of Conakry and 82% of the duties. This deal has drawn scrutiny and criticism, given its perceived lack of fairness.

On January 7, 2025, the Gambia Ports Authority hosted a port stakeholder meeting in collaboration with Albayrak’s group of companies to discuss the transition to the new Public-Private Partnership under the Port Concession.

The Managing Director, Ousman Jobarteh, led the discussions on the modernization agenda, outlining the Concession’s objectives and expectations. He emphasized that this initiative, structured as a Special Purpose Vehicle (SPV), fully involves the Gambia Ports Authority and aims to enhance efficiency and boost productivity.

Meanwhile, Sanyang residents are mounting concerns about the government’s transparency in the Deep Sea Port (DSP) project, particularly following recent statements by Ousman Jobarteh, the Managing Director of the Gambia Ports Authority (GPA).

This announcement has sparked apprehension among hundreds of residents, business owners, and community supporters, who feel that the authorities have not adequately consulted with affected families about property evaluations.

In a letter dated January 30, 2025, Lawyer Lamin J Darbo, the legal representative of the Sanyang community, requested that all facilities related to the DSP project be relocated to the sparsely settled Tourism Development Area (TDA) beyond the Hawaba old settlement, extending to the boundary between Sanyang and Tujereng.

Specific sites include the Hawaba area, Berewuleng Prayer Shrine, Fish Landing Site, the ecologically significant Mangrove Rejuvenation and Planting Area, and the Secret Beikefet River.

The Sanyang community, through its representatives, is advocating for protecting environmentally sensitive areas and eco-tourism facilities from potential impacts associated with the DSP project.

Additionally, they have raised concerns about the DSP master plan’s lack of transparency and the implications of the Concession Agreement for the Sanyang community.

Counsel Lamin J. Darbo raised significant concerns regarding the land earmarked for the Deep Sea Port (DSP) project. He stated that the approximately 100,000 hectares designated by the Gambia Ports Authority (GPA) appear disproportionate to public use criteria. He emphasized that the community feels distressed by the GPA’s method of informing families about property impacts through flyers, which has exacerbated anxiety and uncertainty regarding the project’s implications.

Darbo criticized the GPA for a lack of transparency, suggesting that residents have been kept uninformed about the broader details of the DSP master plan. He argued that the scale of the project indicates the involvement of appropriate consultancy services should have occurred, as it is improbable for such a large undertaking to progress without a comprehensive plan.