By: Kebba Ansu Manneh

The Central Bank of The Gambia (CBG) Governor, Buah Saidy, disclosed on Thursday that the country’s domestic debt stock climbed to D50.1 billion (28.7 percent of GDP) by October 2025, up from D46.4 billion (28.5 percent of GDP) at the end of 2024—an increase of D3.7 billion in just ten months.

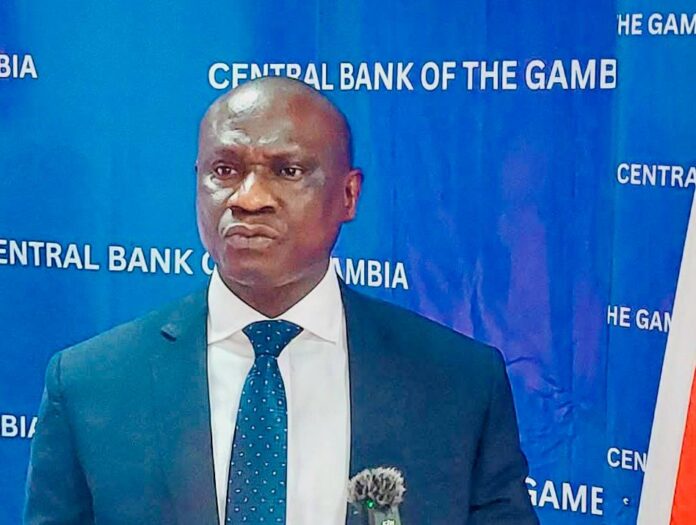

Speaking at the Monetary Policy Committee (MPC) press conference held at the CBG headquarters, Governor Saidy described the rise as consistent with the government’s deliberate shift toward longer-term financing instruments. “The share of medium- and long-term securities continued to increase, now accounting for 47.8 percent of the domestic debt portfolio, while short-term instruments still dominate at 52.2 percent,” he explained.

Despite the higher borrowing, the Governor painted an optimistic picture of the Gambian economy. The Gambia Bureau of Statistics recently revised 2024 real GDP growth upward to 5.6 percent, and the Central Bank maintained its 2025 growth forecast at 6.4 percent, driven by robust private and public investment and strong performance in services, construction, and agriculture.

“Private remittances and public investment continue to support domestic demand,” Saidy noted, while cautioning that global uncertainties and commodity price volatility remain key risks.

On the fiscal front, preliminary data for the first nine months of 2025 show improvement. The overall budget deficit, including grants, narrowed to D6.0 billion (5.0 percent of GDP) from D8.6 billion (6.1 percent of GDP) in the same period of 2024, thanks mainly to more substantial domestic revenue collection and tax administration reforms. However, the deficit excluding grants edged up slightly from D15.2 billion (10.8 percent of GDP) to D15.5 billion (11.0 percent of GDP).

Monetary indicators also reflected expansion. Broad money grew 16.4 percent year-on-year in September 2025 (from 14.4 percent a year earlier), propelled by a surge in net domestic assets. Private sector credit expanded 9.4 percent, a sharp acceleration from 1.9 percent the previous year, while reserve money rose 12.5 percent.

The foreign exchange market remained stable while activity increased. Total foreign currency purchases and sales reached US$2.4 billion in the first nine months of 2025, up from US$2.1 billion during the same period in 2024. Private remittances—a critical lifeline—totaled US$638.4 million, with 24.3 percent originating from the United States.

The dalasi remained broadly stable in the third quarter, appreciating 0.1 percent against the US dollar but depreciating 4.3 percent against the euro, 1.0 percent against the pound sterling, and 2.6 percent against the CFA franc.

Business confidence is also on the rise. The Central Bank’s latest Business Sentiment Survey revealed growing optimism among firms, with most respondents expecting further economic improvement in the final quarter of 2025.

Governor Saidy concluded that, despite elevated domestic borrowing, macroeconomic fundamentals remain solid and the medium-term outlook favorable, provided fiscal discipline and structural reforms continue.